illinois taxes due date 2021

The mailing of the bills is dependent on the completion of data by other local. Now rampant inflation is giving local taxing bodies the power to raise rates by 5.

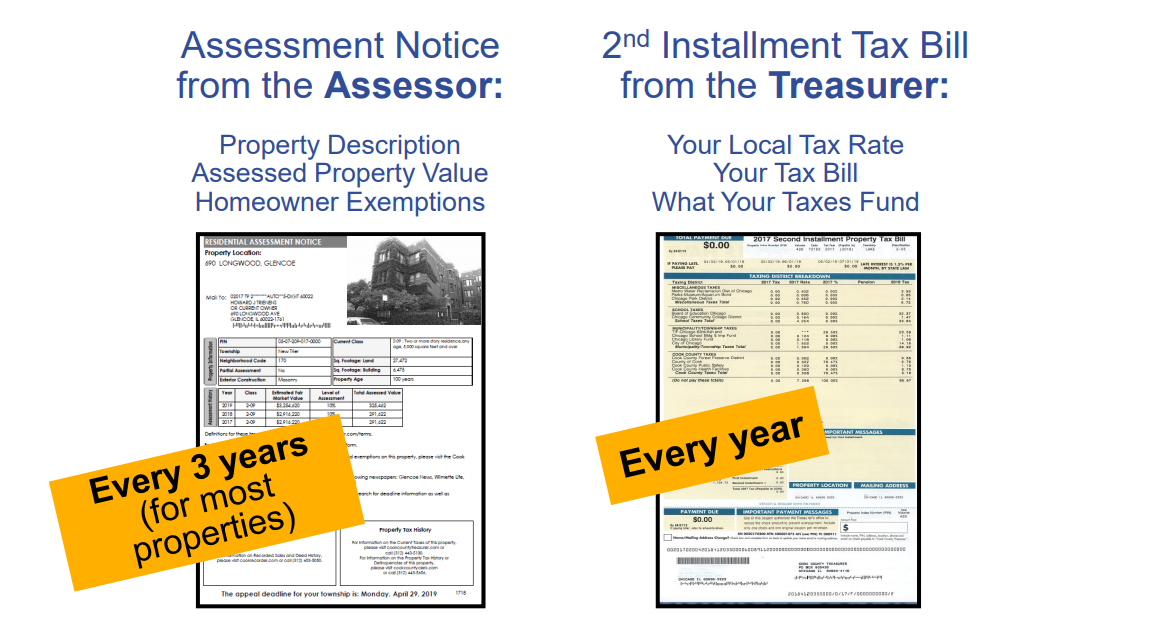

Your Assessment Notice And Tax Bill Cook County Assessor S Office

The due date for calendar year filers is April 15 of the year following the tax year of your return unless April 15 falls on a weekend or holiday.

. Property tax bills mailed. The Illinois 2021 tax filing deadline has been extended until May 17 matching the IRS federal tax filing extension announced Wednesday. Who do I call if there is a problem with my tax bill.

111722 Property Tax Sale. If there is a problem with your assessment or exemptions you will need to contact your Township Assessor or the Chief of County. Illinois Extends Income Tax Filing Deadline Pritzker Announces The extension does not apply to estimated tax payments due on April 15 2021 according to Pritzkers office.

090222 Per Illinois State Statute 1½ interest per month due on late payments. Has yet to be determined. If adopted this amendment will be retroactive to returns for tax year ending December 31 2021 moving the extended due date to November 15 2022.

15 penalty interest added per State Statute. 2021 Real Estate Tax Calendar payable in 2022 May 2nd. June 27th 2022 for the 1st installment and September 6th 2022 for your 2nd installment.

The 2021 pay 2022 Real Estate taxes-Will be in the mail May 25th 2022. 090522 LABOR DAY - OFFICE CLOSED. Beginning May 2 2022.

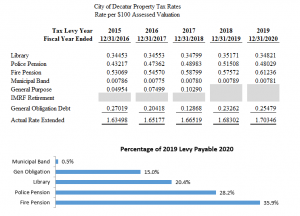

The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022. Q2 Apr - Jun July 20. Illinois was home to the nations second-highest property taxes in 2021.

The Illinois Department of Revenue on October 11 released Bulletin FY 2023-02 Corporate Return Automatic Extension Due Date Change for the Tax Year Ending on December. The state income tax extension does not apply to estimated tax payments that are due April 15 the traditional tax filing deadline. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N.

Q1 Jan - Mar April 20. 090122 2nd installment due date. Illinois Department of Revenue Announces Extended Income Tax Filing Due Date for Corporations.

Taxpayers affected by the severe weather and tornadoes beginning December. The due dates are. Illinois Department of Revenue Director David.

We grant an automatic six-month extension of. 1st installment due date. IRS will delay tax filing due.

County Farm Road Wheaton IL 60187. Tax Year 2021 Second Installment Property Tax Due Date.

Tax Day 2022 When Was The Last Day To File Your Taxes For Most People Kiplinger

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

Federal Income Tax Deadline In 2022 Smartasset

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

Property Tax Information Woodstock Illinois

Estimated Tax Payment Due Dates For 2022 Kiplinger

Due Date Delayed For Upcoming Cook County Installment Property Tax Bills Cardinal News

Fact Check Will Large And Small Illinois Businesses Pay More Under The Graduated Tax Plan Better Government Association

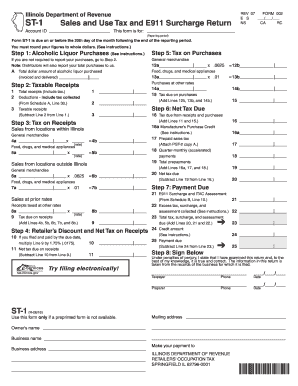

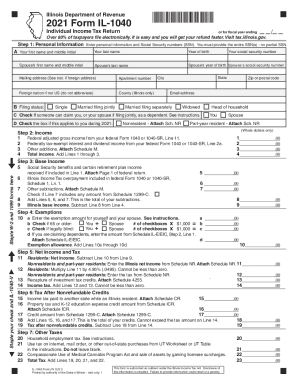

The Illinois Tax Fill Out And Sign Printable Pdf Template Signnow

Property Tax City Of Decatur Il

Welcome To The Illinois Department Of Revenue

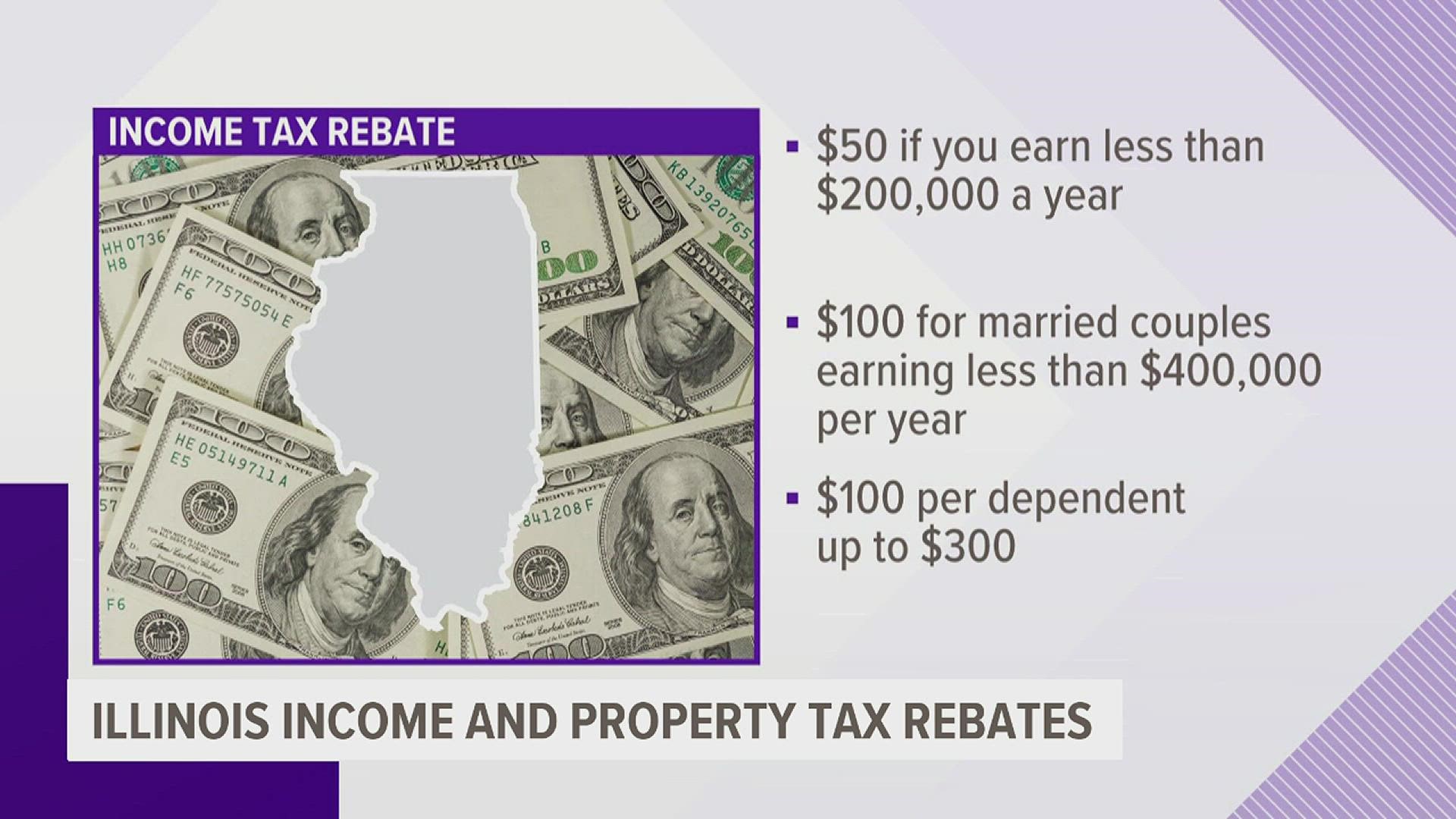

Illinois Sending Out Rebate Checks To Some Residents Wqad Com

Fill Free Fillable Forms For The State Of Illinois

Illinois Taxes Deadlines Extended Due To Covid 19 Wipfli

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

Illinois Sales Tax Holiday Is August 5 14 2022 Dhjj

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

State Tax Filing Deadline Pushed Back For Some Illinoisans Wrsp